tn franchise and excise tax exemption

Departments Franchise and Excise Tax Manual. Next if you dont file the proper exemption a Tennessee LLC is subject to a franchise and excise tax for the privilege of doing business in their State.

Predators Edition All Caps All The Time For Tennessee S Franchise Excise Tax Obligated Member Exemption Carter Shelton Jones Plc

You can read frequently asked questions about the Family Owned Non-Corporate Entity Exemption FONCE exemption for franchise and excise tax.

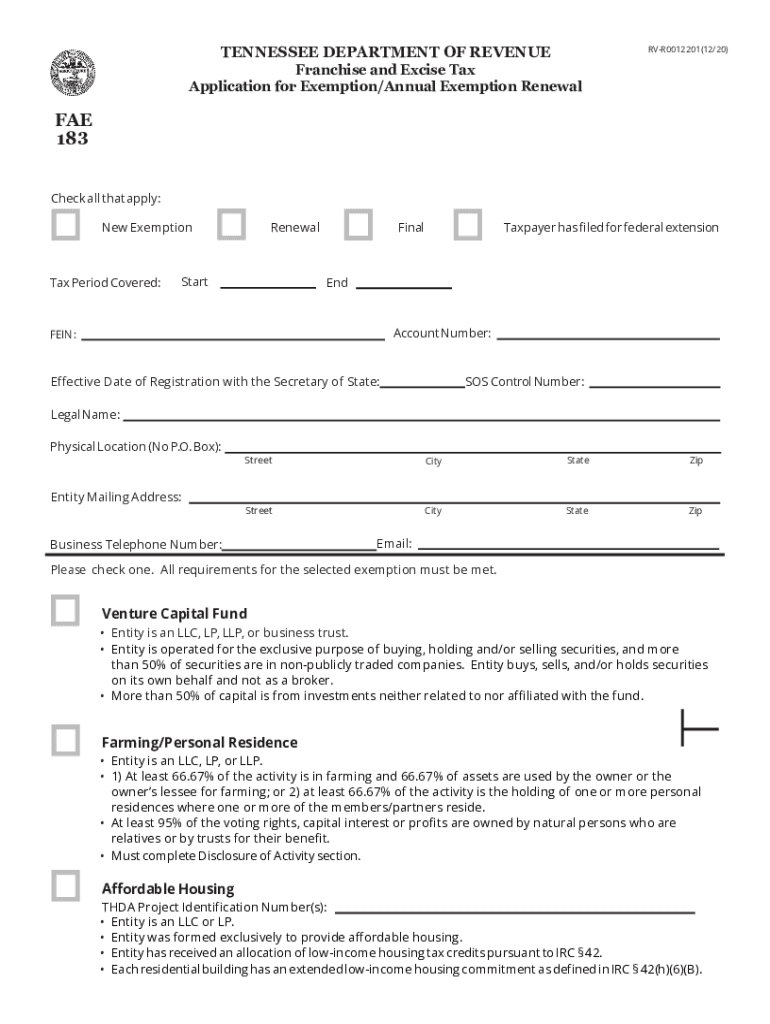

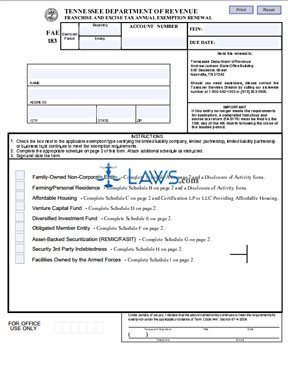

. Ad Download Or Email FAR 183 More Fillable Forms Register and Subscribe Now. We last updated the Franchise and Excise Tax Annual Exemption Renewal in March 2022 so this is the latest version of Form FAE-183 fully updated for tax year 2021. Franchise Excise Tax - FONCE.

FE-9 - Extension for Filing the Franchise and Excise Tax Return To receive a six month extension a taxpayer must have paid on or before the original due date an amount. There are several ways a farm business may be exempt from the. The excise tax is 65.

This potential negative tax effect can be avoided for an affiliated group by making a joint election to compute net worth on a consolidated basis. All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business conducted in Tennessee for the. The excise tax is based on net earnings.

Complete Edit or Print Tax Forms Instantly. The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. Even though Tennessee doesnt have a personal income tax businesses have to pay an excise tax.

The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. Fillable Online Tn Tennessee Application Exemption Franchise Excise Taxes Form Fax Email Print Pdffiller. Schedule A Family-Owned Non-Corporate Entity TCA.

All entities doing business in Tennessee and having a substantial nexus in. Ad Access Tax Forms. APPLICATION FOR EXEMPTION FRANCHISE AND EXCISE TAXES COMPLETE THIS APPLICATION TO REQUESTEXEMPT STATUS FROM FRANCHISE AND EXCISE TAXES.

At least 95 of the ownership units. The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property. Important Notice 09-05 Annual.

Any entity that fails to timely file an application for exemption or renewal may be charged a 200 penalty per occurrence. Go Paperless Fill Sign Documents Electronically. The excise tax rate is 65 of a.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. You may also send an email to tnentertainmenttngov or call 615 741-3456. Tennessee franchise and excise tax laws say that a SMLLC that is disregarded for federal income tax purposes will be disregarded for franchise and excise tax purposes if its single.

To qualify for the franchise and excise tax venture capital fund exemption the venture capital fund must be a limited liability company limited liability partnership limited. The excise tax is like an income tax. Ad Access Tax Forms.

Franchise and Excise Tax Exemptions. 67-4-2008 a 11 Entity is an LLC LP or LLP. Qualified Production Franchise Excise Tax Credit A franchise and excise tax credit is available for tax.

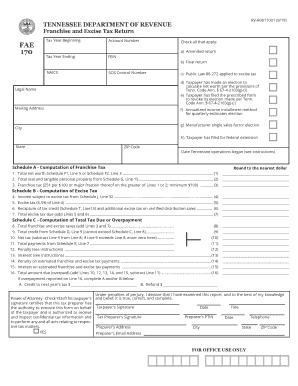

It can be accessed. A completed franchise and excise tax return FAE170 must be filed electronically with a minimum 100 payment of any taxes due by the 15th day of the fourth month following. How much is the franchise tax in.

Application Exemption Type. Filing of Tennessee Form FAE 183 or FAE 170 For the exemptions discussed above the entity will. Web 2 Page Contents Chapter 1.

Ad Fill Sign Email FAR 183 More Fillable Forms Register and Subscribe Now. The exemption will simply be applied to the following tax period.

Tennessee Franchise And Excise Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online

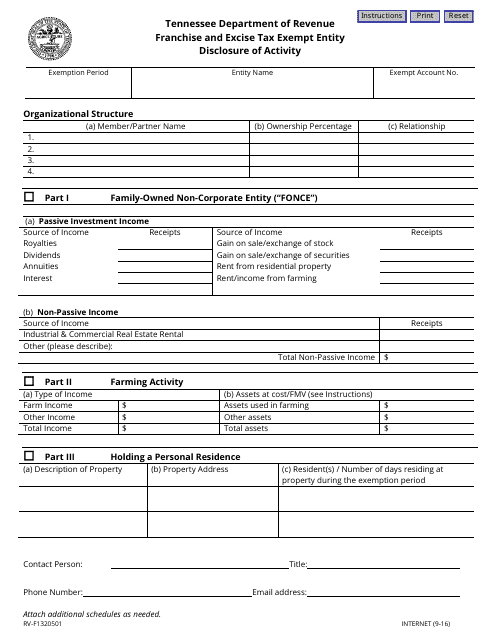

Form Fae Disc Franchise And Excise Tax Disclosure Of Activity Due The 15th Day Of The Fourth Month Following The Close Of Your Books And Records

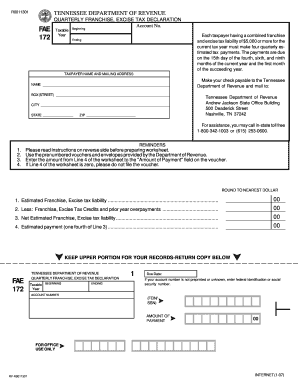

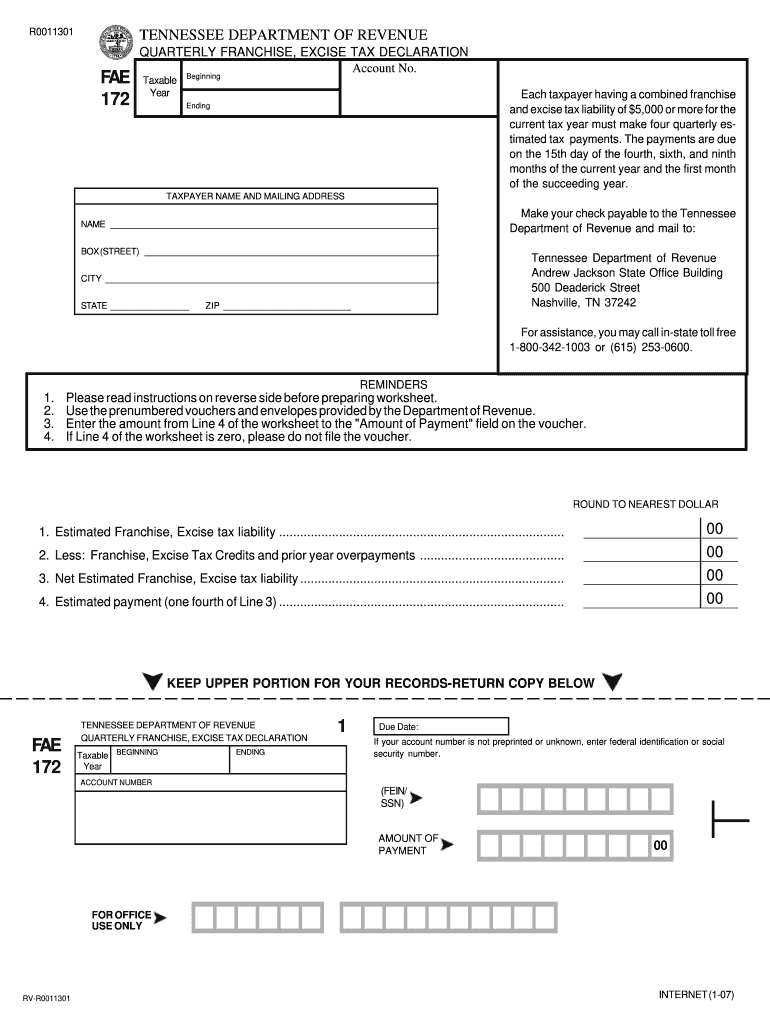

Fae 172 Form Fill Out And Sign Printable Pdf Template Signnow

More Help Available For Tennessee Business Owners

Tennessee 2019 Form Fae 172 Fill Out Sign Online Dochub

Tennessee Cpa Journal July August 2022

Fill Free Fillable Forms State Of Tennessee

Tennessee Cpa Journal May June 2015 Page 16

Form Fae 183 Franchise And Excise Tax Annual Exemption Renewal Due The 15th Day Of The Fourth Month Following The Close Of Your Books And Records

Tennessee Clarifies Franchise Excise Tax Could Affect Georgia Business

Fae 183 Fill Out Sign Online Dochub

What Federal Tax Reform Means For Tennessee

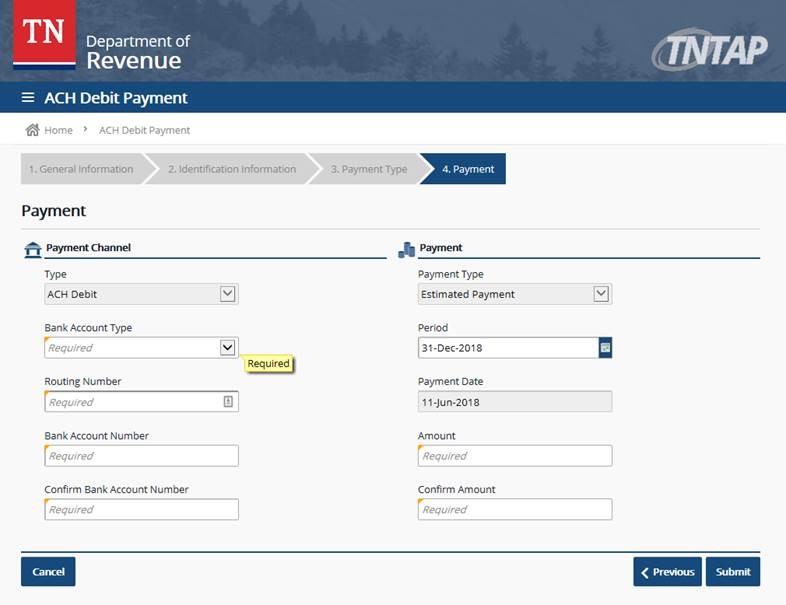

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

How To Form An Llc In Tennessee Llc Filing Tn Swyft Filings

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

Free Form 183 Franchise And Excise Tax Annual Exemption Renewal Free Legal Forms Laws Com

Form Rv F1320501 Download Fillable Pdf Or Fill Online Franchise And Excise Tax Exempt Entity Disclosure Of Activity Tennessee Templateroller

How To Pay Professional Privilege Tax If You Receive A Letter To Pay Your Professional Privilege Tax Here A Quick Look At How To Pay It S Simple Go To Http Tntap Tn Gov Eservices And